A consumer-driven boycott of U.S. goods and services started taking shape in early 2025. It began as a grassroots reaction in Canada and parts of Europe. Shoppers, activists and some local governments began avoiding American brands in protest of new U.S. trade and foreign-policy moves.

Now it expands world wide.

Why it started — tariffs, politics and law

The first trigger was politics: The U.S. started talking about annexing Canada and Greenland, by force if necessary, early this year, and their populations, as it was expected, hated it.

Another early trigger trigger was a sweeping U.S. tariff package announced in April 2025. The White House rolled out a “baseline” tariff and higher, country-specific “reciprocal” duties that many trading partners viewed as abrupt and punitive. Those measures prompted swift talk of retaliation.

Beyond trade, activists and consumers pointed to other grievances. These included U.S. positions on the Israel genocide in gaza, domestic laws aimed at restricting the Boycott, Divestment and Sanctions (BDS) movement, and controversies tied to surveillance and national-security policy. International legal actions — such as South Africa’s case at the International Court of Justice and ICC activity related to the Gaza conflict — also reinforced the boycott’s political backdrop for many participants.

How the boycott organized

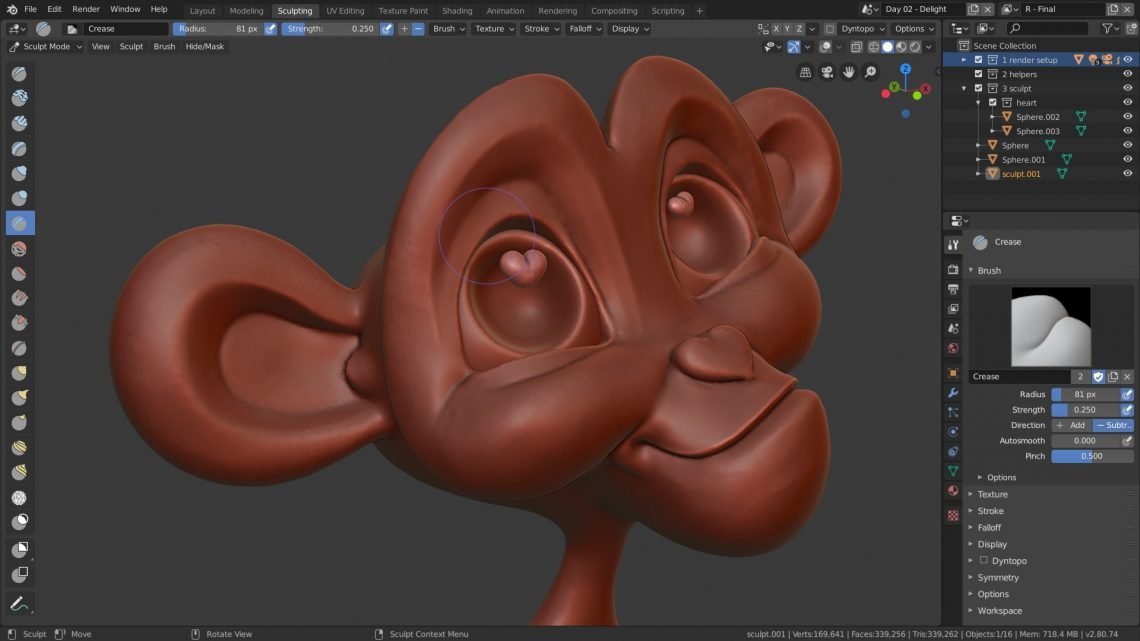

The movement was decentralized. Social media communities, dedicated subreddits and volunteer websites sprang up to share lists of U.S. brands and local alternatives. Apps that scan product labels or photos to show origin and corporate ownership climbed app-store charts in affected countries. One such Canadian app, Maple Scan, marketed itself as a tool to help shoppers verify “Canadian-made” products.

Retailers and volunteers also produced guides and browser extensions that suggested local substitutes. Large, loose networks of activists used these tools to coordinate “buy local” campaigns rather than centralized, formal sanctions.

Country snapshots

Canada

Canada quickly became the focal point of consumer reaction. Reports and footage of stores removing or de-prioritizing some U.S. items circulated widely, and provincial leaders signalled political pushback against certain U.S. suppliers and contracts amid tariff disputes. Some provincial procurement decisions and media accounts amplified the impression of an organized, national campaign to prefer Canadian suppliers.

Europe

In several European countries public opinion polls and social-media group membership suggested a high level of consumer willingness to avoid U.S. goods. Retailers in the region adjusted merchandising to help shoppers pick non-U.S. alternatives. Denmark’s largest grocery operator, for example, began adding a small symbol on price tags to highlight European brands — a move retailers described as responding to customer demand rather than an explicit company boycott.

Corporate and government responses

Some companies and public bodies reacted decisively. A number of retailers began labeling or promoting European and domestic alternatives; other firms publicly urged calm and cautioned about the complex supply chains that make “country of origin” hard to determine. In Canada, at least one provincial government paused or canceled contracts with U.S.-based suppliers amid the height of the dispute. The debate pushed some public institutions to discuss using open-source software or non-U.S. vendors for sensitive systems — a preference framed by some officials as a way to reduce dependence on foreign software with unclear provenance.

Measurable economic effects

Analysts and travel trackers registered visible short-term impacts. International visits to the United States fell sharply in early 2025 compared with 2024, with tourism forecasters revising inbound travel estimates downward. Sectors dependent on cross-border visitors, including hotels, attractions and some regional economies, reported declines that industry groups said could translate into billions in lost spending if the trend persisted.

Automotive demand also shifted. Well-publicized drops in Tesla registrations in parts of Europe in early 2025 were reported by industry trackers and news outlets, while some traditional automakers and Chinese brands made short-term gains in market share. Observers cautioned that multiple factors — price changes, model cycles and competition — all influenced these shifts, making it hard to isolate boycott effects.

Culture and activism

Beyond wallets and balance sheets, the boycott had symbolic effects. Sporting crowds in some border events booed the U.S. anthem. Musicians and cultural figures canceled or postponed U.S. tours. Politicians in affected countries used the moment to encourage domestic spending and tourism at home. For campaigners, such cultural signals mattered as much as the economic numbers: they were proof that consumer choices could send political messages internationally.

Criticisms, limits and practical hurdles

Economists and trade experts warned that consumer boycotts face structural constraints in a globalized economy. Brand ownership, multinational supply chains and components made abroad complicate the simple idea of “buying American” or “avoiding American” in practice. Critics also noted the movement’s reliance on U.S. digital platforms for organization — a contradiction highlighted by organizers themselves. Finally, analysts suggested that, historically, boycotts tend to squeeze corporate margins more than national GDPs — consumers substitute rather than abstain entirely.

If you wish to join the movement, here is a list of alternatives to several american products/companies.

Read more on the Wikipedia page.

Like my content? Support me with a tip!