The Ibovespa, Brazil’s benchmark stock index, has continued its streak of historical highs, achieving its 11th consecutive record closing at the 155,000 points mark. This remarkable feat also marks the 14th successive increase for the B3 index, nearing the 31-year-old record of 15 consecutive gains set during the implementation of the Plano Real in 1994.

“The absence of significant economic data, such as inflation and labor market figures in the United States, has implications for the Federal Reserve’s interest rate decisions,[…]The market was concerned that without official economic data due to the shutdown, the Fed might not have the conditions to cut interest rates again in their next December meeting.”

– Noted Andressa Bergamo, an investment specialist and founder of AVG Capital

Throughout the trading session today at B3, Brazil’s stock exchange, the Ibovespa fluctuated between 154,058.43 and 155,601.15 points, setting a new intraday record and closing at 155,257.31 points, a 0.77% increase with a trading volume of R$ 22.1 billion($4 billion). The index has risen 3.82% this month, bringing the year-to-date gain to 29.25%, edging closer to the 2019 mark of 31.58%.

Marco Noernberg, a partner and equity strategist at Manchester Investimentos, highlighted that the Ibovespa’s appreciation over the past month has surpassed 10%. The upcoming week’s agenda, filled with significant events, could either act as new catalysts for growth or prompt profit-taking after the index’s prolonged winning streak.

“Keep an eye on the Copom minutes released early tomorrow, which could provide clues about the future of the Selic rate, and the official October inflation data, which will also be unveiled on Tuesday, 11th,[…] Both the minutes and the IPCA could offer fresh perspectives influencing the onset of interest rate cuts.”

– Noernberg advised

Felipe Cima, an analyst at Manchester, suggested that if October’s IPCA reveals another lower-than-expected inflation rate, it might lead to further downward revisions in the inflation forecasts in the Boletim Focus. This could pressure the Copom to adjust its stance, potentially moving the expectation for an interest rate cut from March to January.

This series of records underscores the resilience and growth potential of Brazil’s stock market, despite global uncertainties and challenges. Investors remain cautiously optimistic, closely monitoring key economic indicators and policy decisions that could shape the market’s trajectory in the coming months.

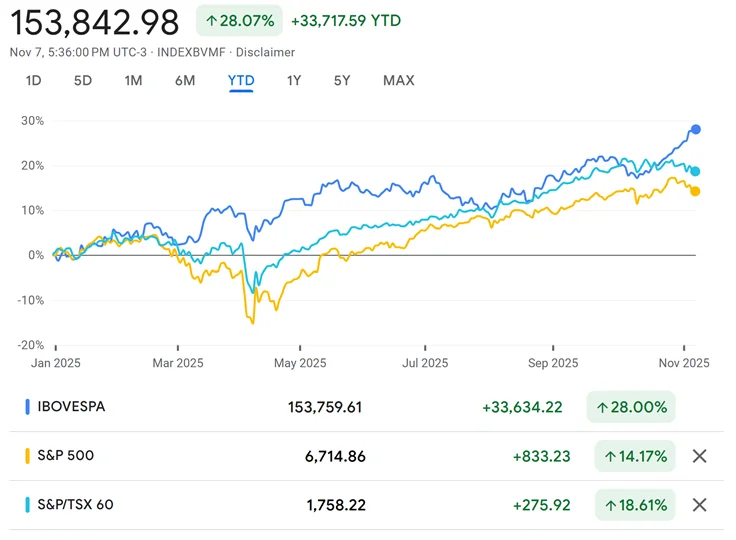

Brazilian and Canadian markets outpace America despite US’ economic aggression

Brazil and Canada have faced U.S. economic aggression, with Brazil being penalized for prosecuting an insurrection and Canada under threat of economic annexation. Yet, their stock markets have demonstrated remarkable resilience. Brazil’s index has surged almost 30% this year as mentioned about, and Canada’s TSX 60 index has climbed nearly 19%, outpacing the S&P 500’s more modest 14% gain.

When currency appreciation is factored in, the contrast becomes even more pronounced. The Brazilian Real has appreciated by 18% and the Canadian dollar by 2.4% against the USD, further boosting returns for local investors.

For instance, a Brazilian investor who converted to USD to invest in the S&P 500 would have faced a 6% loss. A Canadian investor would have seen a mere 11% return from S&P 500 investments. Conversely, American investors have reaped significant rewards by looking north and south: 35% gains in Brazil and 21% in Canada.

Source: UOL

Like my content? Support me with a tip!