In a significant shake-up within the artificial intelligence (AI) industry, Chinese startup DeepSeek has unveiled its latest AI model, R1, developed at a fraction of the cost typically associated with such technology. This development has led to a substantial decline in Nvidia’s stock value, highlighting potential shifts in the AI market dynamics.

Deepseek R1

DeepSeek R1 is a type of AI that’s really good at understanding and creating human language, a transformer-based model.

If we compare DeepSeek R1 to ChatGPT O1, another top AI, we see they both achieve similar scores in majority of tests. Most benchmarks show that, when compared, R1 either gets the uper hand by a small margin, or loses by a small margin.

In mathematics DeepSeek-R1 achieved a score of 79.8% on the AIME 2024 mathematics test and 97.3% on MATH-500, slightly surpassing o1’s scores of 79.2% and 96.4% respectively. Then In coding tasks, DeepSeek-R1 attained a Codeforces rating of 2,029, outperforming 96.3% of human programmers, while o1-1217 scored 96.6%.

Cost-Effective AI Model

DeepSeek’s R1 model was developed with an investment of just $5.6 million, a stark contrast to the hundreds of millions or even billions spent by U.S. tech giants like OpenAI and Anthropic. Despite the lower investment, R1’s capabilities are reported to rival those of its Western counterparts, and that has attracted investments.

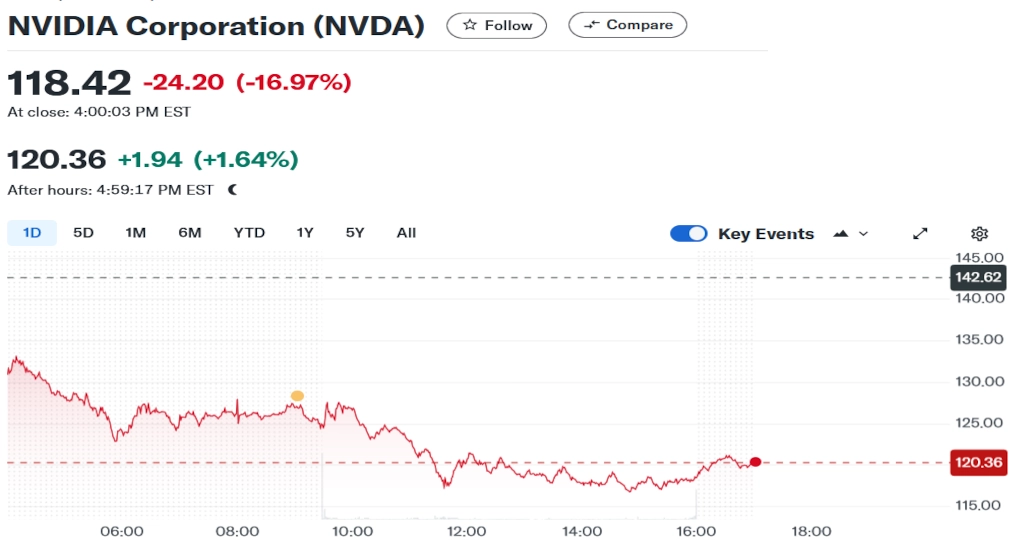

Following the announcement, Nvidia’s shares plunged nearly 18% on Monday, marking the company’s most significant single-day decline since March 2020. Investors are concerned that DeepSeek’s cost-effective approach could reduce the demand for high-end and expensive chips, which are integral to Nvidia’s business model.

Reevaluation of U.S. AI Investments

This development has prompted a reevaluation of the substantial investments made by U.S. tech companies in AI research.

In 2024, leading firms, including Microsoft, Meta, Alphabet, and Amazon, collectively spent around $236 billion on capital expenditures, with projections indicating that spending could exceed $300 billion in 2025. On top of that, current United States’ president Trump recently announced an investment of 500 billion in A.I. infrastructure.

DeepSeek’s success suggests that effective AI solutions can be achieved with significantly lower expenditures, potentially challenging the prevailing paradigm of high-cost AI research.

Nvidia’s Market Position

Despite the recent downturn, Nvidia remains a dominant player in the AI chip market, commanding a significant share. However, the emergence of cost-effective models like DeepSeek’s R1 may prompt tech companies to focus more on efficiency and return on investment, potentially reducing future demand for advanced computing power. This situation may cause Nvidia’s future to ne uncertain.

Source: Investopedia, analyticsvidhya

Like my content? Support me with a tip!